The main cost for EPR ‘producers’ for 2025 will be the payment of the base fee, expected to be invoiced in October by PackUK, the renamed Scheme Administrator. The last offering of this fee was in December 2024, so there has been considerable anticipation amongst producers and compliance schemes as to whether the final iteration would see significant change.

Friday 27th June saw not just the base fees but a number of other publications that has shed light of further EPR developments. However, it was the base fees that were the most eagerly awaited.

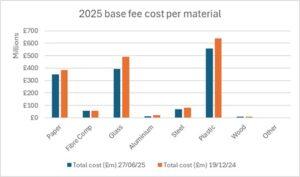

The table below shows the change from the December fees with glass being the main volume beneficiary although only fibre composite increased.

| Publication date | Paper | Fibre composite | Glass | Aluminium | Steel | Plastic | Wood | Other |

| 19/12/2024 | £215 | £455 | £240 | £435 | £305 | £485 | £320 | £280 |

| 27/06/2025 | £196 | £461 | £192 | £266 | £259 | £423 | £280 | £259 |

| Difference | -8.8% | 1.3% | -20.0% | -38.9% | -15.1% | -12.8% | -12.5% | -7.5% |

This will be welcomed across the board, especially by producers affected by the glass fee.

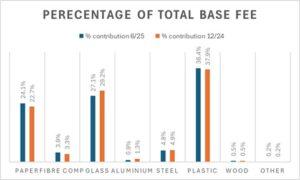

The total contribution to local authority costs by each material has consequently changed:

This calculation is made by adding household packaging tonnages (less PET, aluminium and steel drinks packaging that is exempt from the base fee due to their Deposit Return System status) to the tonnage reported as ‘binned’ packaging and then multiplying by the material base fee.

For glass it is more complicated. Although the data shows the majority as exempt drinks packaging, as only Wales is including it in DRS, the figure can’t be used for calculation. The amount of 2.05m tonnes quoted in the 2023 Valpak Packflow report has therefore been used.

If the glass figure is correct, then a total of £1.46bn will be raised in 2025 with glass’s contribution falling by over 2% and plastic’s rising by 1.5%.

Invoices to each producer based on the central RPD system calculation will be sent out in October with producers then able to pay in four instalments.

But Friday did not just see the release of the base fee. There was also a Regulatory Position Statement published stating that enforcement action would not be taken against producers that didn’t apply the complex Recyclability Assessment Methodology modulation system to their first half data for 2025. However, it was emphasised that producers must still separately identify rigid and flexible plastic packaging. There was also confirmation that Defra were reassessing the definition of household packaging to take account of ‘dual-use’ packaging that has hit the hospitality industry so hard. This is packaging current defined as household – and therefore subject to the base fee – which actually ends up in commercial waste paid for by the waste producer eg a hotel.

Defra has also stated in a letter sent out by all UK governments, that they are seeking to resolve the ‘unintended consequences of the current PRN/PERN and waste export systems, compromising our domestic capacity’ on glass and plastic although interestingly, not on paper that has a far higher dependence on exports.

Producers have expressed strong concerns that the base fee will be used by Local Authorities to plug funding gaps elsewhere, but the Defra letter explains that ‘the Secretary of State for Environment, Food and Rural Affairs has instructed PackUK to exercise its existing powers within the pEPR regulations to ensure local authorities in England only receive pEPR funds that are spent on household packaging waste management and recycling’. Whether Local Authorities in the rest of the UK will also be instructed to ring-fence is unclear.